Business Protection - Control and Certainty

Specialist Advice Services provides facilitation and advice services to business owners and executives. We have a focus on providing services in relation to business succession, key person, loan guarantor and personal protection needs. Our objective is to protect your business and the owners against the impact created by an unexpected death, disability or critical illness of key people or equity partners.

When advising clients in relation to their business protection and succession planning needs, there are four key areas which are carefully considered:

Loan Protection

If business debts are secured by personal assets, have the consequences of personal guarantees been considered? Find out more...

Key Person Protection

Would the loss of a key employee result in a loss in revenue and profitability? Find out more...

Shareholder Protection

In the event of your death or disability who takes control of your business and how would you or your estate extract the value of your equity from the business? Find out more...

Fixed Overheads Protection

How would business expenses like rent, loan repayments or payroll be paid if you weren't able to operate your business? Find out more...

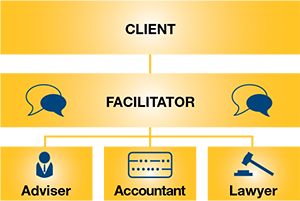

How does the facilitation process work?

As facilitators, we will work closely with your team of advisers (accountants, lawyers, etc) to project manage a business protection and succession plan specifically tailored to your business.

Our broad based process allows us to coordinate funding and legal solutions in a timely and cost effective way, that ensures you can focus on what you do best; running your business. Our corporatised structure means we can offer our clients significant savings via fee for service and premium rebate offerings.